Stunning Tips About How To Reduce Federal Withholding

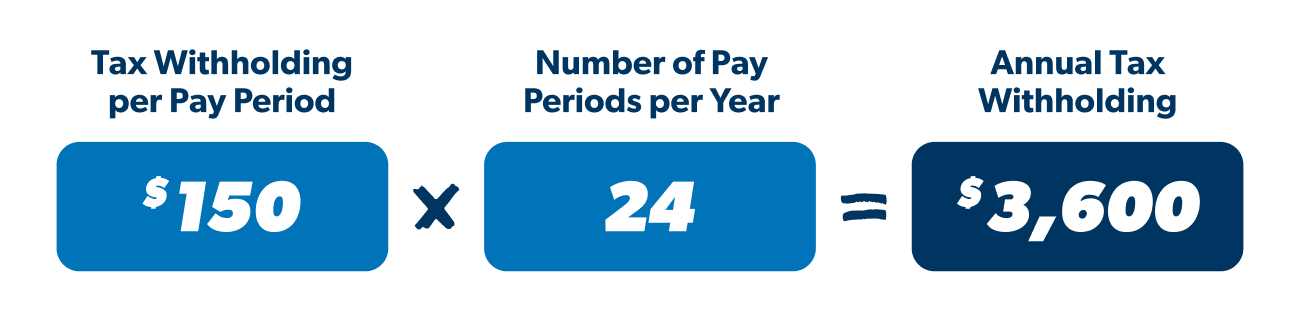

How to reduce tax withholding visit the irs website at irs.gov and navigate to the withholdings calculator.

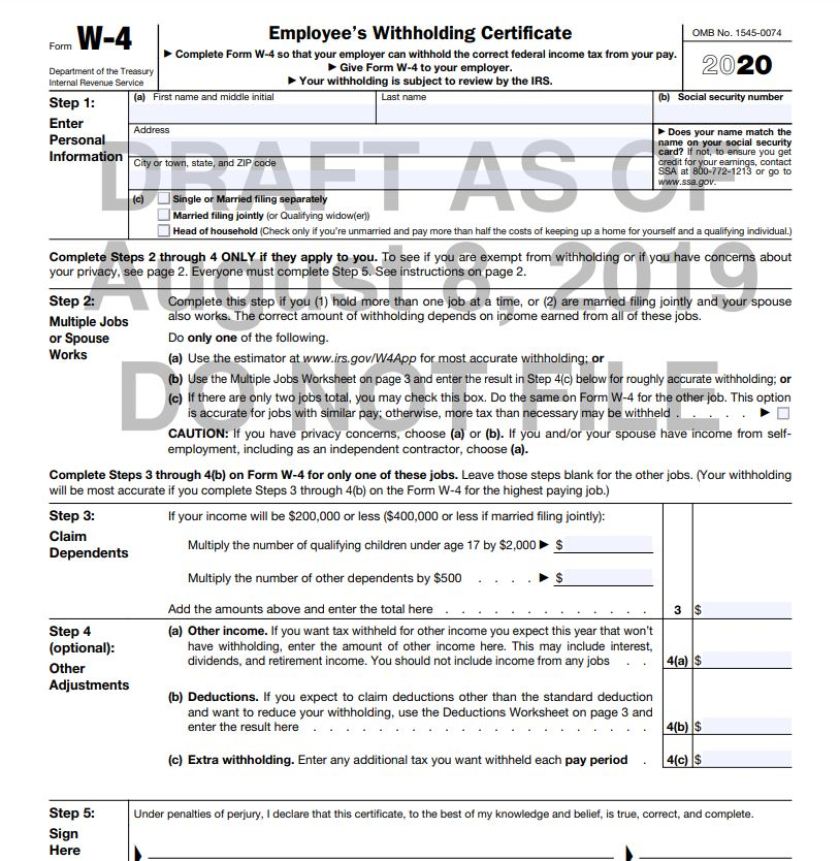

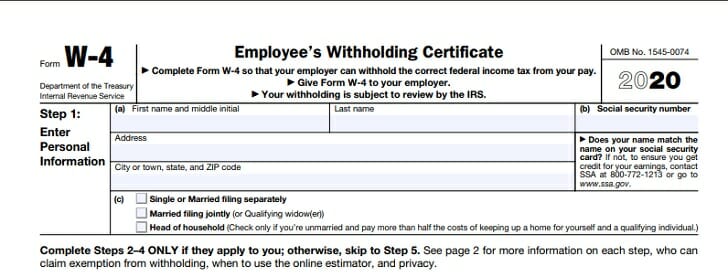

How to reduce federal withholding. Use the same tax forms you used the previous year, but substitute this year's tax rates and. It's for any situation where you need to reduce withholding. Line 3 reduces the amount of tax withheld line 4.

This new form offers employees four ways to change their withholdings, depending on how much they work throughout the year: One way people can get the new tax year off to a good start is by checking their federal income tax withholding. Line 3 to reduce the amount of tax withheld;

Increase the number on line 4 (b). A good first stop is with the irs tax withholding estimator, which asks you about your filing status, number of dependents, income amounts, income sources, adjustments to. One way to adjust your withholding is to prepare a projected tax return for the year.

Use the instructions in publication 505, tax withholding and estimated tax. Reduce the number on line 4 (a) or 4 (c). Increase the number of dependents.

Enter your information in the calculator and determine your. You can ask your employer for a copy of this form or you can obtain it. Step 3 on the form supplied by my employer says “claim dependents”, so i’m confused on.

They can do this using the tax withholding estimator on. Decreasing the number of allowances means paying. Line 4(c) to increase the amount of.

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)